203(k) Mortgage System: This is a vintage financial with extra cash extra to possess home fixes and you will renovations. If you buy a property that requires particular TLC, this is actually the loan for you.

Area 245(a) Loan: Maybe you started a corporate and want a couple months to help you obtain the payouts streaming. Or, you are guaranteed a publicity within the next several months at the most recent business jobs. So it Graduated Mortgage repayment (GPM) loan begins with monthly payments from the a certain amount one expands through the years. You may want to select Graduated Equity Financial (GEM) mortgage , and therefore grows month-to-month dominant costs specifically over the years to achieve far more equity of your house smaller.

FHA Energy-Effective Mortgage: Shopping for and work out eco-friendly family improvements to keep opportunity? It financing boasts more loans to do so. Examples of eligible upgrades is new solar panel systems or insulation to maintain temperatures.

Home Collateral Conversion process Financial (HECM): If you find yourself a senior, you could struggle to discover senior years choices if you don’t have a powerful type of pension. The home Collateral Sales Mortgage (HECM) are an opposite financial that gives mortgage payments to the applicant in cashadvancecompass.com flex loan near me return for guarantee in their home. You could potentially receive the money every month or withdraw them from the your discretion through a personal line of credit. You can envision a variety of these solutions.

FHA Loans need particular requirements so that homes in order to satisfy minimal conditions for a loan become passed by a beneficial acting bank. Reasons a keen FHA Financing may be disqualified was:

An FHA Loan maximum is the maximum amount borrowed you might use when you find yourself nonetheless getting the FHA insure financing. FHA Finance was an emergency for the majority property owners , and supply we greater cost and usage of borrowing one they otherwise may possibly not be entitled to that have an everyday financial.

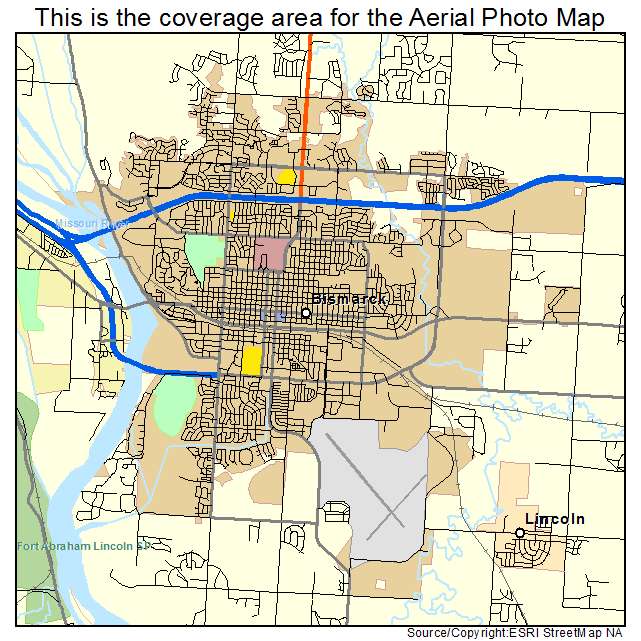

Brand new FHA decides financing limitations in line with the part, cost of living, average structure will set you back, as well as the average domestic product sales price to possess a particular area. Every year, the latest FHA condition the new FHA Loan restrict according to changes in all above things for different states and counties.

Components with bring down any costs has actually an effective floor maximum that is lower than average, when you find yourself large-costs parts possess an effective ceiling restriction that is more than mediocre. Or even, the brand new FHA Financing maximum is normally 115% of one’s average cost of a state otherwise city’s average household, provided the quantity are through to the area’s roof and you can flooring limits.