Are you experiencing their center set on a home a little aside of finances? We all know, one to protecting the adequate and correct financing is never effortless.

However with an excellent strategic believed that assist off a mortgage broker, one may obtain the necessary amount borrowed, needless to say which you can service and even if your income is found on the reduced front side.

One of the recommended an approach to alter your probability of borrowing from the bank a higher count should be to carefully assess the discretionary purchasing. Imagine gymnasium memberships, Netflix profile, Spotify, Fruit Tv and you can insurance costs. These types of expenditures will wade missed but can somewhat impact the borrowing from the bank feature. Thus, are they important? Aseem says you to definitely of the distinguishing places that expenses can be cut, you make your self more appealing to loan providers:

Due to the fact Credit Contracts and you can Consumer Loans Work (CCCFA) may have been rolling straight back, banking institutions still examine these can cost you when contrasting loan requests, the guy demonstrates to you. All the way down such as for instance expenditures, high the borrowed funds number, you can get.

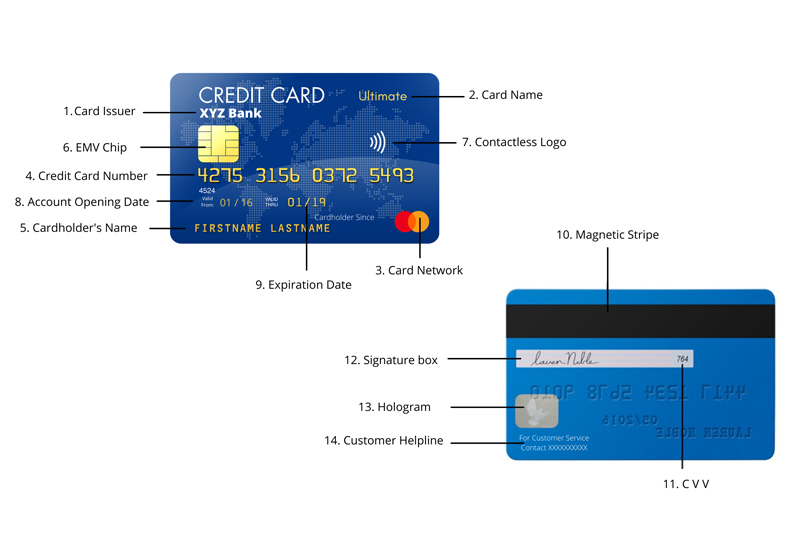

In the event a good credit score credit management could work on your favour, Aseem notes that your particular credit limit is incorporated since an excellent discretionary costs.

Banking institutions tend to calculate 3 to 5% of mastercard limit as the a compulsory bills. So, when obtaining a home loan, ensure that it it is towards smallest amount.

For those who have such brief-label financing or get instructions or personal loans, try either in order to combine or treat they to help you minimum or repay an equivalent if at all possible. Lowest installment having eg loans/ hire orders makes you eligible for higher quantity of mortgage to however your home.

Should your most recent salary cannot meet the endurance into financing you desire, you need to sign up for a part-go out job to help you supplement your revenue? Preferably, the medial side hustle are long lasting to show legitimate and consistent earnings. Aseem claims a large number of his customers enjoys properly put an enthusiastic most income source to increase the credit capacity. When your suggested property size is in a fashion that you can keep boarder/ apartment friends and can secure a lot more rental earnings, delight take action since the such as for example extra money also helps locate way more financing allow to purchase a home which you choose to purchase while making you safe in making financing repayments with ease.

Kainga Ora is additionally help those individuals consumers with a combined money regarding $150K per year, to help you acquire limit you’ll number also you have just 5% dumps out-of any origin in order to get your dream domestic to own very own life style. To find out more, you could potentially get in touch with or band 09 255 5500

Today, we cannot assume loan acceptance prices was consistent across the every banks. Aseem claims you will find differences when considering The Zealand banks. Per financial keeps very own group of conditions, chance examination and you will inner formula you to dictate how much the lending company is actually happy to give in order to a potential homeowner. Affairs like your creditworthiness, income balance and you can credit history are all taken into account. Now, financing approvals between financial institutions disagree It indicates you are able to help you acquire more from the looking around, and also into ideal terms and conditions demonstrates to you Aseem.

Securing an effective financial into a reduced money may appear difficult, however, armed with suitable suggestions and you will means, it could be at your fingertips. From the lowering expenses, controlling borrowing smartly, investigating an area earnings, and you can comparing lender products, you’ll be well on your way not only to maximising their amount borrowed and recovering small print such as all the way down interest, large cash return etc.

Every piece of information and you may posts authored are correct towards best of the global Money Qualities Ltd degree. Because recommendations provided contained in this website was out of standard characteristics that’s not intended to be customized financial pointers. We remind one look for Monetary recommendations that’s customized oriented on your own need, requirements, and you may items prior to making any monetary decision. Nobody or persons exactly who count directly otherwise ultimately through to suggestions contained in this article will get keep Globally Monetary Qualities Ltd otherwise blog link their employees liable.