If you find yourself a veteran or active army with an excellent Va-recognized financial, there are 2 a way to make the most of historically reasonable refinance rates: by using aside an interest rate Prevention Refinance loan (IRRRL) otherwise by firmly taking away a funds-aside refinance loan. Per features its benefits and drawbacks, however, both can enable you to get big monthly deals when the your be eligible for a interest.

Like any mortgage, mortgages supported by the brand new U.S. Department out of Experts Situations (VA) is refinanced locate greatest mortgage words-and additionally less interest, which means lesser monthly obligations and cash stored throughout the a lot of time manage.

Rates of interest has reached a most-time low. For folks who have a Va financing additionally the mathematics produces feel, it is extremely advantageous to refinance, claims Draw Reyes, CFP, monetary suggestions expert during the Albert, an automated currency government and you will spending software. Reyes factors to the current rates of interest (at the time of ) anywhere between 2.5% to 3% having fifteen- and you may 31-12 months fixed-price mortgage loans.

One eg in the event it might make sense for you to envision this is if you’ve got solid credit. In general, lenders render a lot more advantageous refinance rates to the people which have a steady money, a history of in charge borrowing use, and you will a low financial obligation-to-income proportion. So if you possess a powerful credit profile and can safer reduced pricing, it is a worthwhile choice for you.

Another thing to imagine: Think of how much time you want into staying in your residence. Can you imagine We realized I happened to be delivering a long-term changes away from route to another, claims Eric Bronnenkant, lead off taxation from the Improvement, good robo-mentor an internet-based lender, and an experienced themselves. Which are an excellent counterargument to possess doing it. Once you learn with many cousin certainty that you’re going to be effortlessly forced to flow, this may be may well not make as frequently financial experience [to help you refinance your home].

One to refinance alternative, when you yourself have an effective Va-supported financing, is actually mortgage loan Prevention Refinance mortgage (IRRRL). Called an improve refinance, a keen IRRRL makes you refinance their Virtual assistant-backed mortgage to find a potentially down rate of interest or switch out-of an adjustable rate so you can a fixed price. No matter if a keen IRRRL are backed by the newest Va, you would get the mortgage out of a bank, borrowing relationship, or any other lender.

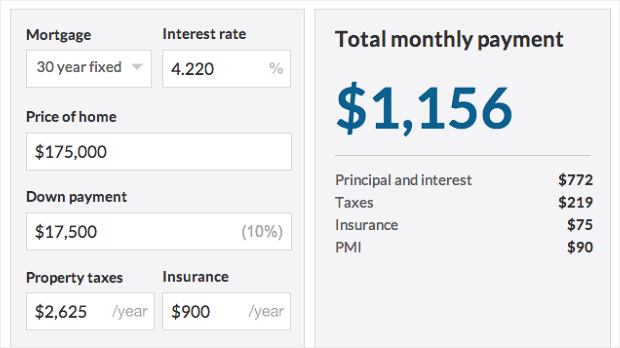

With a keen IRRRL – or other Virtual assistant mortgage – you simply will not have to pay private financial insurance coverage (PMI), that is generally speaking between $29 so you’re able to $70 30 days per $one hundred,100000 on mortgage, according to Freddie Mac computer. Most conventional loan providers require you to shell out PMI if one makes a down payment which is lower than 20% of the house’s worthy of.

Several other cheer of an enthusiastic IRRRL is you need not offer far documentation. In place of a money-out refinance, elements to own documents are much down to own an IRRRL, states Bronnenkant. Usually, lenders will require one render data files to show the income, possessions, and you will financial obligation you self-review of the application form, to be certain that your creditworthiness. Which have an IRRRL, the duty out-of evidence is significantly lower, thin app procedure payday loans Pebble Creek is easier.

By using the money of a profit-aside refinance to evolve your own residence’s well worth, you could potentially subtract the loan notice – around $750,100000, indeed.